Self-worth is a broad topic that has so many intricacies. Some people may not value themselves as much as they should. Others may value themselves very highly but may not have the tools they need to communicate their worth to employers. Then of course, are those that fall somewhere in between.

Negotiating a higher salary for yourself than what is initially offered can mean the difference between simply surviving and having that extra cushion to travel, start a family, treat those you love to nice experiences — in a word, thrive. Many people, however, feel that discussing money with an employer, whether in a job interview process, or as a raise in a current role, is taboo. Study after study shows that this is especially true for women, a fact that pains me to my core.

Asking for more money doesn’t have to be anxiety-inducing or feel like a huge risk. In fact, if done correctly, asking for what you’re worth can lead to increased respect.

Here’s how to do it.

Before we get started: It’s a classic “don’t” in job interviews, but it bears repeating here. Don’t be the first to bring up money. Jumping to the topic of pay too quickly can send the message that you’re more interested in getting that paycheck rather than doing the work.

I’m going to refer to amounts in this post as annual salary, so if you’re looking at roles that pay hourly, you can just do a quick conversion: multiply your hourly rate by 2080 and voila, that’s your annual income assuming you work 40 hours per week. (52 weeks per year x 40 hours per week).

Do your research

If you don’t have a Glassdoor account, sign up for one now. It’s free and you can find everything from employee reviews about company culture, to job listings, interview questions, and my favorite — the salary calculator tool which can help you determine whether or not you’re paid fairly in your current job, if your offer is competitive, and what the market rates are for your level of experience, location, and job title.

Do your best to understand the full scope of your job-to-be by scrutinizing the job listing and digging further during interviews. If this is a big increase in responsibilities from your previous roles, it should also be accompanied by an increase in pay. Also consider geographic region. Would you be moving from Alabama to the Bay Area? If so, your salary should reflect cost of living along with elements of the job itself. Salaries for fully remote work can vary drastically depending on the company and I’ve seen that it’s an excuse for companies to pay less because of the geographic flexibility you get. So know what you’re getting into.

Pay transparency laws

A number of states, counties, and cities across the US have already enacted pay transparency laws which require employers to list salary ranges on job advertisements for work that could be done in that state. These laws are aimed at giving workers more leverage to negotiate their earnings and to close wage gaps. To find out which areas have passed these laws and how you might be affected, visit CNBC.

Don’t leave money on the table

I know an accounting professional who moved from one lower-paying region of the country to a much higher-paying one but didn’t adjust their salary requirements for that change. They also didn’t think critically enough about the increase in job responsibilities they were taking on. A double-whammy. They later found out that the person working in that role before them was making $40,000 more than them. The moral of this story, companies will do you dirty if you give them the opportunity. Everyone loves a good deal and saving money — hiring managers and compensation teams are no exception — so don’t lowball yourself.

Speaking of lowballing, I did the exact same thing as the accountant when I jumped from my first job in my career to the second. It was a massive increase in responsibilities and title. I was making $31,000 per year in my first job and I didn’t do enough research on what I should realistically have been making in the next. I thought that I simply had to use my previous salary as the benchmark, compounded by this idea that asking for more than a $15,000 increase would somehow seem greedy. When I asked for $45,000, instead of simply accepting the “deal” they could have gotten, this employer actually gave me another chance to up my salary request. That was a big eye-opener and something I haven’t experienced since. I could have more than doubled my salary from one job to the next if I hadn’t limited myself and my thinking.

Adding some padding

Even if you’re not relocating or drastically increasing your responsibilities in the role you’re interviewing for, it’s generally a good idea to pad the lower number of your range. When I was about five years of experience in to my career and applying for jobs at larger corporations, I tended to put my bottom range number at $10,000 higher than what I was realistically hoping for. (If you have more experience than that, or are jumping up in title, such as associate to manager, or manager to senior manager, you’ll want to add more padding where it makes sense.) In my scenario, best case, they’re cool with it and I float away with dollar signs in my eyes. Medium case, they knock it down so they can feel good about themselves, and you still get what you originally wanted. Worst case, they balk at this number and decide to not to move forward. This leads me to my next point.

Finding the sweet spot

I have a peer who managed people and was involved in hiring at a legal firm. She said that when it came time to talk salary, there was often $10K of wiggle room that if people didn’t ask for it, they didn’t offer it. But if the candidate asked for too much, they’d reject the person outright. This is pretty standard across industries for mid-level jobs. So knowing when to push and when to accept plays in big. It’s a balancing act.

There is a special sauce to salary negotiations. Eighty percent is being prepared, understanding what you’re getting into, and doing your research. The other 20 percent is a potentially scary factor: You have to feel it out and use your intuition. If you’re not quite sure how you’ve been received in your interviews, or if the recruiter has indicated that there’s not much wiggle room but you’re excited about the position and understand that there’s room for growth, it could be wise not to push. But if your confidence level is high, you’re feeling positive that you have wooed them and made a great impression, and the recruiter gives you an indication that it’s time to play ball, go for it. It’s really up to you and your comfort level.

Who shows their cards first?

You should always be prepared to talk money in an interview. Recruiters hiring for temporary or contract jobs often have to check a box from the discussion, so don’t be alarmed — or worse, unprepared — if they ask. If an interviewer asks what your salary requirements are right out of the gate, and you’re still unsure of what all the job even entails, it’s perfectly acceptable to say “I’d like to learn a little more about the role first.” You can also turn the table and ask if they have a target range in mind. (Hint: they do, but they might be looking for an epic deal as I mentioned above.) Keep a cool head here; don’t panic and shoot yourself in the foot by feeling pressured to just blurt something out.

Salary history ban laws

Employers in all states used to be able to ask job applicants about their current salaries or how much they were paid at previous jobs. Many years ago I was asked to produce a salary history document during a hiring process. But now that there’s a national dialogue about gender inequality and pay discrimination; times are changing. Here’s what the American Bar Association has to say about salary history bans:

“The purpose of these laws […] is to break the cycle of discriminatory pay practices. Women and racial minorities have, historically, been paid lower wages and salaries than men and non-minorities. These laws are intended to help close the pay gap by preventing new salaries from being based on previous (and potentially “low balled”) salaries—and thereby allowing past salaries to follow a candidate around for their entire career. A prospective employee who has earned less in the past than other prospective employees is more likely to accept a lower wage or salary than someone who has historically earned more; and employers, cognizant of that information, are more likely to offer that employee a lower wage or salary. Salary history bans level the playing field by removing arguably discriminatory pay history as a factor in determining future compensation.”

I love the way that’s put — a low salary can follow you around for your entire career. Use the advice in this article and do everything you can to keep that from happening. Another way to arm yourself with information is to find out exactly what employers can and can’t ask about you in your state. For a state-by-state rundown including links to the actual legislation, visit HRDive. Note that this was last updated 2022, so a quick Google search can help if you don’t see your state listed.

Knowing when to push and when not to

Once when I was finalizing a contract job, I asked about the possibility for pay negotiations and the recruiter discouraged me from it. She said their budget was pretty set and it might turn them off. It was an amazing company and opportunity so I trusted her advice and accepted as is. A year later I was converted to a permanent, full-time role on the team and within three years, my salary increased by 30 percent. I had a feeling patience and good performance would pay off in the long run, so factor that in to your strategy as well.

If you see promise, know that folks are well-paid in your organization, and see a future for yourself there, playing the long game can work. But if you accept a lowball offer and expect things to just naturally work themselves out later (i.e. more money magically appears), this can lead to a lot of frustration and resentment. No one has a crystal ball, but if you feel things out, make educated guesses, and arm yourself with research, you’ll be in a much better position.

You’ve gotten the offer, now STOP

It’s happened — you’ve gotten the offer. Yay! Ideally, you’ve completed your salary negotiations before you get the job offer. Nothing on the offer letter should be a surprise to you. If this isn’t the case, take a moment, stop, breathe, and think about whether or not this is capturing your worth. The most tempting thing in the world when you get that offer letter is to sign and submit it all in the same breath. The recruiter has also likely put a bit of urgency around your acceptance or maybe even a timeframe. But do yourself a favor, do not immediately accept it if you think you can do better.

Your compensation package

Remember that in many jobs, there are other levers you can pull during salary negotiations besides The Number — your base pay. You can negotiate other things such as a signing bonus, more vacation days or paid time off (PTO), or more company stock. Signing bonuses are often referred to as “golden handcuffs,” because if you leave the company within that first year of hire, or whatever the terms are, you’ll have to pay it back. If you’re unsure that you’ll be able to commit to a year, or whatever the timeframe is, tread lightly. And for the love of everything that’s holy, read every word of the fine print on that offer.

Someone once even recommended to me to ask if I could have my insurance coverage start immediately instead of after 90 days. Although I don’t think a lot of companies delay benefits coverage any more, this is likely out of the control of the compensation team, so I wouldn’t recommend asking for this, unless you’re applying at a smaller company where this may still be feasible and negotiable.

Tying it all together

Salary negotiations can be nerve-racking. After all, your livelihood is on the line. If you nail the money part down in the beginning, it can mean the difference between renting for a few more years or buying a house. Continuing to contribute just enough to your 401(k) to get the full match or maxing out your annual contribution. Sweet, sweet retirement.

But remember that in most cases, employers expect you to and respect you for negotiating your pay. It all ties into the topic of self-advocacy in the workplace, which I’m a huge fan of and will write more about in future posts. And it all starts before you even start your job.

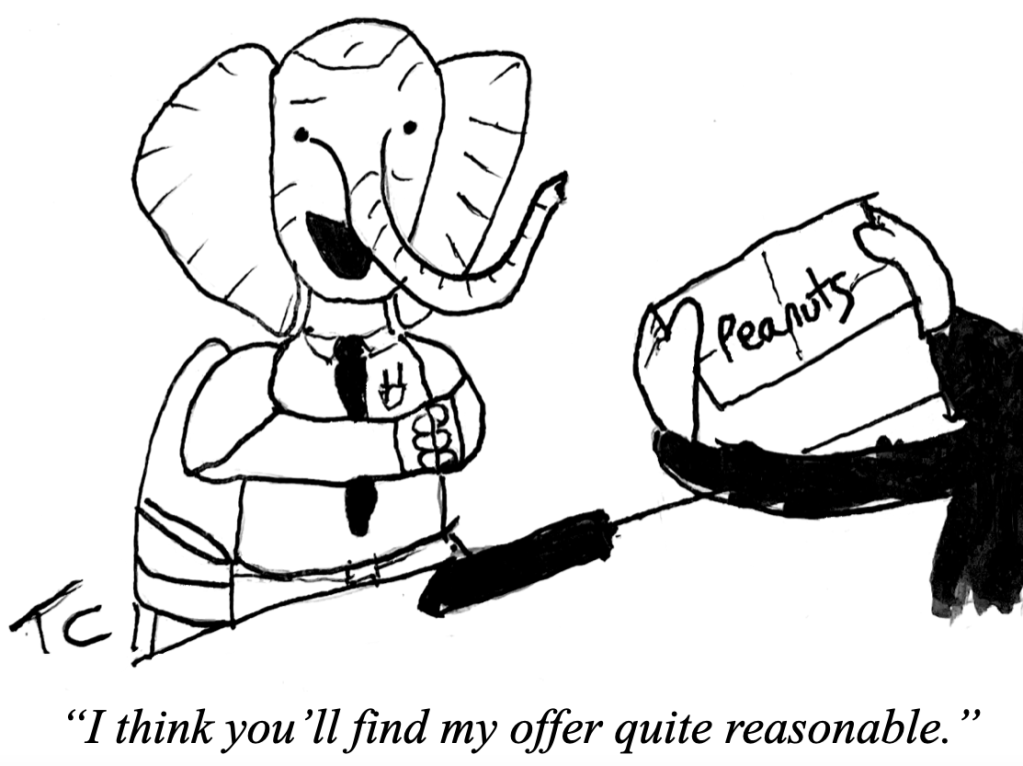

To balance out this heavy topic, I’ll leave you with this. It’s a quote that I’m always reminded of when I think of negotiations.